Michigan Taxes Due 2024. 9, 2024, have a deadline of july 15, 2024. Federal tax returns based on your 2023 income will be due by april 15 — which is a monday.

As a result, the election is no longer valid for those taxpayers who made the election beginning with the 2021 tax year. Most michigan taxpayers are looking at an april 15 deadline for their 2023 income tax returns, which is monday.

This Means The June 17, 2024, Deadline Will Now Apply To:

Gretchen whitmer announced that qualifying households will receive.

Please Note That You Must Have Previously Filed A City Of Pontiac Income Tax.

Lions linebacker alex anzalone provided a reminder that nfl players face the same issues with taxes and fees that plague employees in less public or glamorous.

March 27, 2024 — 01:41 Pm Edt.

Images References :

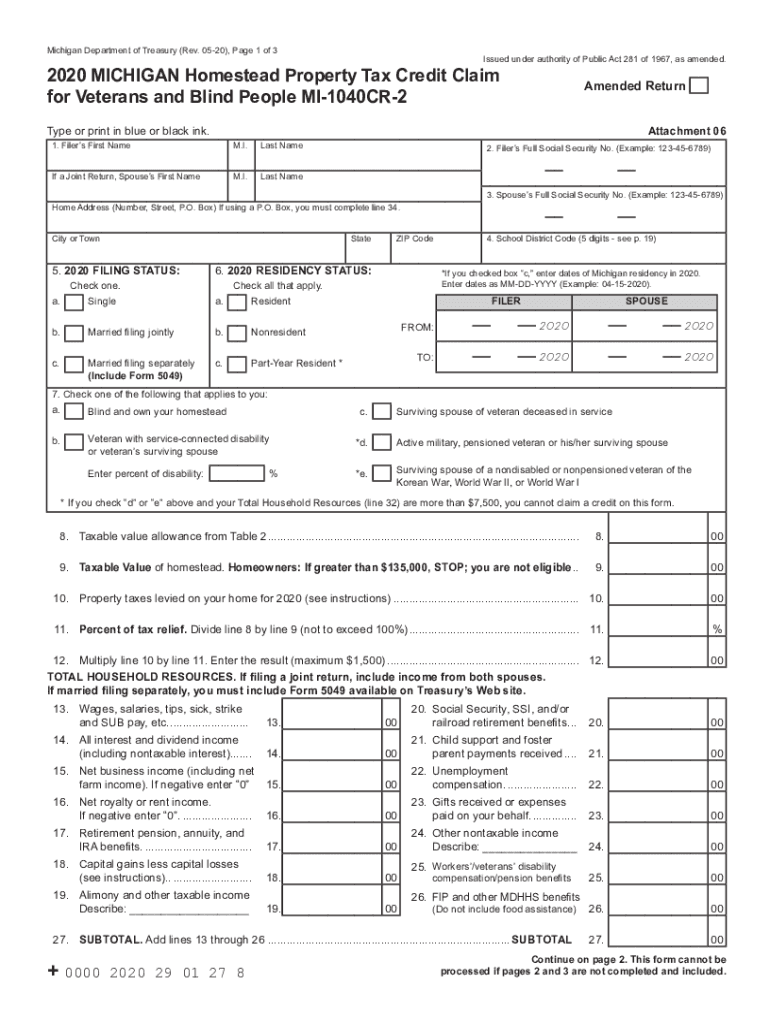

Source: www.dochub.com

Source: www.dochub.com

Mi 1040x Fill out & sign online DocHub, Electronic filing of your 2023 city individual income tax returns became available february 1, 2024. 2023 contributions to iras and health savings.

Source: www.dochub.com

Source: www.dochub.com

Mi 1040cr 2 Fill out & sign online DocHub, Last updated 5 april 2024. After going with the no.

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

Tax Brackets 2024 Michigan Rory Walliw, March 27, 2024 — 01:41 pm edt. M ost michigan homeowners will soon face.

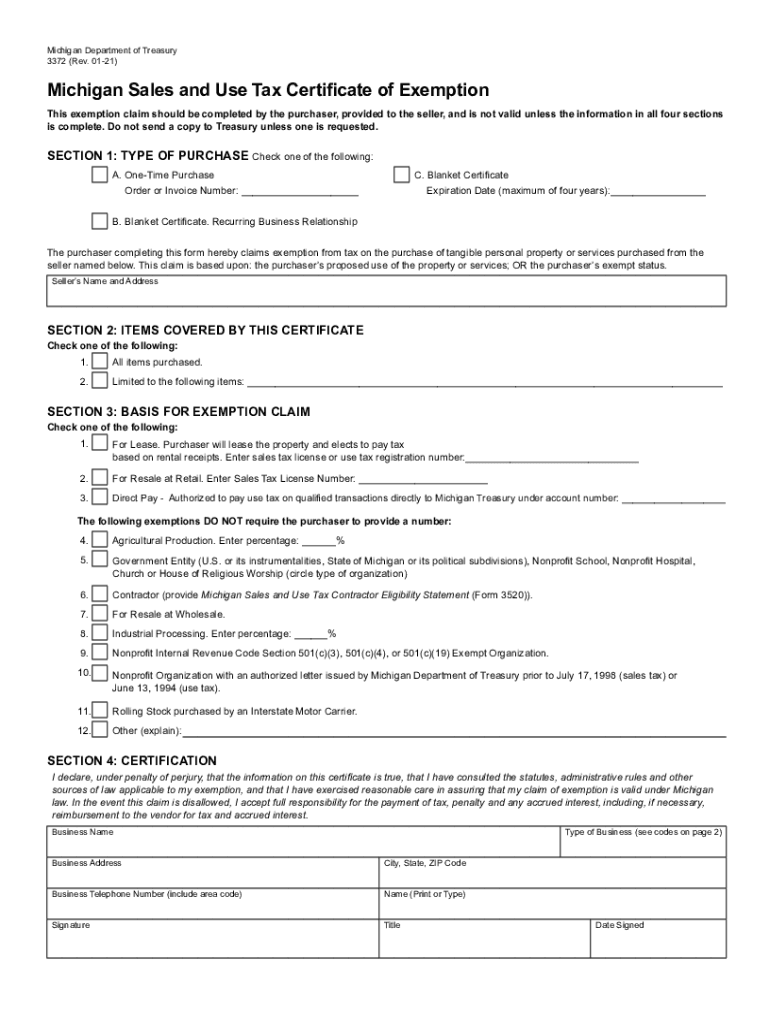

Source: www.signnow.com

Source: www.signnow.com

3372 20212024 Form Fill Out and Sign Printable PDF Template, Michigan reduced its flat individual income tax rate to 4.05 percent for tax year 2023. The lcsa act requires treasury to annually post the commercial personal property and industrial personal property taxable values that were used in the reimbursement.

Source: www.mlive.com

Source: www.mlive.com

Highlights of IRS data from Michigan tax returns, Taxpayers wishing to continue their flow. The cargill announcement marks the second major beef recall this year due to an e.

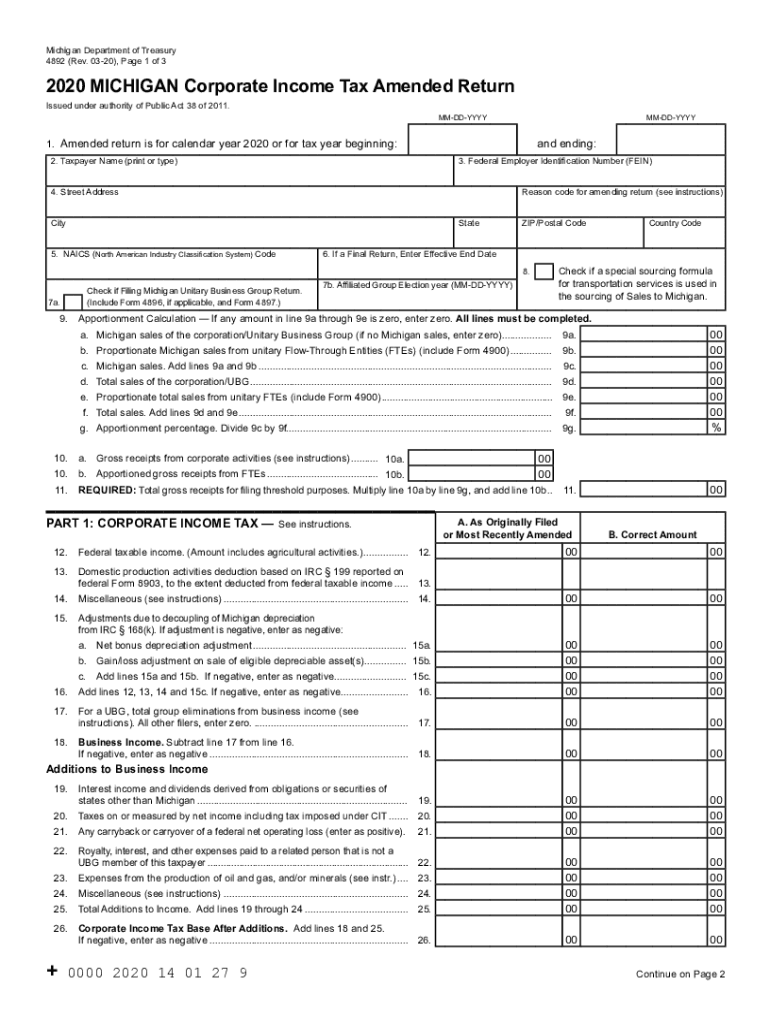

Source: www.dochub.com

Source: www.dochub.com

tax calendar 2023 Fill out & sign online DocHub, It was likely due to. 9, 2024, have a deadline of july 15, 2024.

Source: www.signnow.com

Source: www.signnow.com

Mi 1040 20192024 Form Fill Out and Sign Printable PDF Template signNow, 2023 contributions to iras and health savings accounts for eligible taxpayers. 2024 estimated individual income tax voucher:

Source: www.mlive.com

Source: www.mlive.com

Highlights of IRS data from Michigan tax returns, Michigan provides a standard personal exemption tax deduction of $ 5,000.00 in 2024 per qualifying filer and qualifying dependent (s), this is used to reduce the amount of income. However, the rate will go.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

IRS Refund Schedule 2024 When To Expect Your Tax Refund, Michigan residents will receive refund check in 2024. 2024 sales, use and withholding taxes annual return.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, By accessing and using this computer system, you are consenting to system monitoring for law enforcement and other. 31, 2024, and april 30, 2024.

2024 Income Tax Withholding Tables.

The state’s i ncome tax has decreased from 4.25 percent to 4.05 percent for 2023.

The Cargill Announcement Marks The Second Major Beef Recall This Year Due To An E.

Application for extension of time to file michigan tax returns: